Corporate Transparency Act — Beneficial Ownership Information Reporting Requirement (BOI)

Update as of March 22, 2025

BOI Reporting No Longer Required for U.S. Companies

As of March 21, U.S. companies no longer need to file Beneficial Ownership Information (BOI) with FinCEN. This change simplifies compliance for U.S. based businesses, freeing them from the filing requirements under the Corporate Transparency Act.

What You Need to Know:

- U.S. businesses and their owners are now exempt from BOI reporting.

- Foreign companies registered to operate in the U.S. still need to file BOI, but they are not required to report U.S. owners.

- Deadlines for foreign companies depend on when they registered to operate in the U.S.

- Registered before March 21, 2025: BOI reports due 30 days after publication of the new rule.

- Registered after March 21, 2025: BOI reports due 30 days after registration approval.

This change is part of FinCEN’s effort to streamline reporting requirements. A final rule is expected later this year. Click here to read the latest news release from FinCEN.

Update as of March 4, 2025

Yet Another Corporate Transparency Act Update

On March 2, U.S. Department of the Treasury announced that it will “not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines, but it will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies or their beneficial owners after the forthcoming rule changes take effect either.” For the full announcement check out the press release.

By March 21, we expect the new interim rule to be issued. For now businesses do not need to worry about the March 21 deadline – stay tuned for additional announcements.

Update as of February 28, 2025

The BOI Roller Coaster Continues

Yesterday FinCEN announced that “it will not issue any fines or penalties or take any enforcement actions against companies based on any failure to file or update beneficial ownership information (BOI) reports pursuant to the Corporate Transparency Act by the current deadlines.” For the full announcement, visit FinCEN’s website.

The new interim final rule will be issued by March 21. So for now businesses do not need to worry about the March 21 deadline – stay tuned for additional announcements.

Update as of February 20, 2025

BOI Reporting Requirements Back In Effect

After recent legal developments, BOI reporting requirements are once again back in effect with a new filing deadline of March 21, 2025 for the majority of reporting companies. Additional information can be found at fincen.gov/boi.

Update as of January 24, 2025

BOI Updates Continue

Despite ongoing court activity this week, BOI reporting remains voluntary. For more details, please refer to the alert released by FinCEN by clicking here.

Update as of December 27, 2024

Yet Another BOI Update

And another BOI update! On December 26, 2024 the Fifth Circuit court vacated the motion to stay the injunction. In other words, FinCEN currently cannot enforce the BOI reporting requirements.

So far FinCEN has not updated their website or made it clear if filing is voluntary again or if they will provide any further delays to filings beyond January 13.

In connection with the American Institute of Certified Public Accountants (AICPA), we still recommend gathering the required information and being prepared to file the BOI report if the injunction is lifted again.

Update as of December 23, 2024

CTA Once Again Enforceable

Due to a federal Court of Appeals decision on December 23, 2024, the Corporate Transparency Act (CTA) is again enforceable – requiring reporting companies to file beneficial ownership information with FinCEN. Most companies now have until January 13, 2025, to file their beneficial ownership information reports with FinCEN.

Update as of December 4, 2024

Federal Court Decision in Texas

On December 3, 2024, a Texas federal court issued a nationwide preliminary injunction against enforcing the CTA’s reporting requirements. This decision halts all compliance requirements, including the submission of Beneficial Ownership Information Reports for existing reporting companies, which were originally due by January 1, 2025. The preliminary injunction provides relief to millions of business entities registered in the U.S. classified as reporting companies. Reporting companies are not required to comply with the Act’s filing deadlines or other obligations while the injunction remains in effect.

What Does This Mean for Your Business?

- For reporting companies that have already filed BOI Reports, no further action is needed.

- For reporting companies that have NOT filed BOI Reports, there is NO legal obligation to comply with the Corporate Transparency Act by year-end.

Looking Ahead

While this preliminary injunction offers a temporary reprieve, it’s crucial to understand that should the injunction be lifted or reversed on appeal, enforcement of the Act could resume, and compliance requirements would be reinstated. The decision underscores the ongoing legal debate, and the situation may evolve as higher courts review the case.

Update as of September 16, 2024

How to Meet Your Company’s Beneficial Ownership Information (BOI) Reporting Obligations

Most business entities in the U.S. face a new obligation to report their beneficial owners to FinCEN. Failure to report timely or accurate information can result in steep civil penalties in excess of $500 per day and even criminal penalties for willful violations. As the end of the year approaches, we aim to provide practical guidance to help you avoid any adverse consequences and instead proactively meet the new requirement.

This article, authored by our partners at Harbor Compliance, provides a step-by-step guide to managing the full BOI reporting process.

1. Determine your reporting deadlines

The deadline to file depends on when your business entity was formed. If you have multiple business entities or regularly form or acquire new entities, you will likely need to track multiple ongoing deadlines.

- The deadline is January 1, 2025 for entities in existence (i.e. were formed with their state) before January 1, 2024.

- Entities formed during 2024 have 90 days to file from the date they are incorporated or organized with the secretary of state.

- In 2025 and after, newly created entities have only 30 days to file an initial BOI report.

In addition, at any point in the future, updates or corrections to previously reported information must be submitted to FinCEN within 30 days of the change. If an entity is dissolved, FinCEN also needs to be notified via an updated report. Critically, this makes BOI reporting an ongoing, not just a one-time, obligation.

2. Understand which entities are exempt

Many business owners ask whether the new reporting requirement applies to them. The reality is that most entities have to report unless they meet one of FinCEN’s 23 categories of exemptions. If the entity has to report, we will use the term “reporting company” in the rest of this article.

These exemptions are generally confined to highly regulated industries such as insurance companies, banks, and tax-exempt nonprofits. One exemption, for large operating companies, applies to businesses that have over $5 million in gross receipts, 20 employees, and meet a few other criteria. Trusts and homeowners’ associations (HOAs) are not automatically exempt either and are encouraged to review FinCEN’s requirements closely.

We encourage businesses to review the list of exemptions and seek legal counsel if necessary. Once the business determines it is not exempt, it should proceed through the rest of this checklist.

3. Determine who the beneficial owners are

For any reporting company, FinCEN requires information about its beneficial owners, i.e., the natural person(s) who own more than 25% of, or have substantial control over, an entity.

Practically speaking, most small businesses can easily identify who their owners and controlling parties are. That’s not always the case in more complex organizational structures with multiple entities, indirect owners, boards, and investors.

This step can be the most time-consuming for more complex organizations. The business should strongly consider seeking legal counsel for advice or answering any uncertainties. Regardless, whether the entity’s beneficial owners change or if the entity makes an inadvertent mistake on its initial filing, FinCEN simply requires an update or correction. Entities that submit those subsequent filings inside the 30-day window are highly unlikely to face adverse consequences.

In other words, most entities benefit from proactive reporting and investing in a solution that ensures updates and corrections are filed in a timely manner.

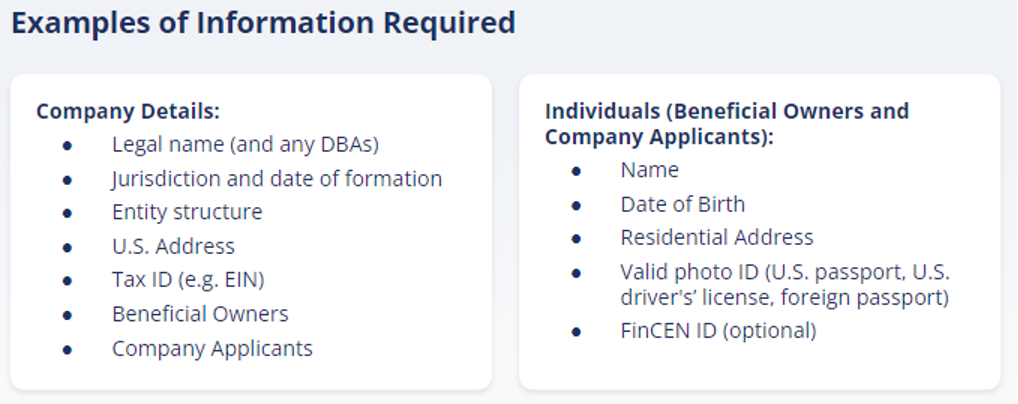

4. Collecting and storing information

FinCEN requires two “buckets” of information for each reporting company: information about the company, and information about the beneficial owners. Below are examples of what you can expect to provide:

There are two new terms on this image you might need to familiarize yourself with.

- “Company Applicants” are required for newly formed entities beginning in 2024. These are the people who create the entity with the secretary of state or cause the entity to be created. This is especially important information to collect if you formed your own business in 2024 or hired a service company or law firm to create it for you. If your entity existed before 2024, this information isn’t required.

- “FinCEN ID” is a unique identification number that a company applicant or beneficial owner can apply for. This greatly simplifies the reporting process, especially when that person is associated with multiple entities. The person who obtains a FinCEN ID simply updates their address and photo ID information on their personal FinCEN ID record—and saves the hassle of having to file individual updated reports for each entity.

Getting a FinCEN ID is free and takes just a few minutes to obtain online.

While the information required is straightforward, there are two main challenges for businesses.

First, the report requires Personally Identifiable Information (PII) of the owners, which should be protected from unauthorized access. Many companies lack secure systems to collect and store this information, which makes outsourcing BOI reporting to a technology provider a sensible option.

Second, the need to report changes to information over time. Remember, any change or correction to previously reported information must be submitted to FinCEN within 30 days. Businesses should evaluate whether they have a system in place to not only store that previously reported information, but to ensure those changes are gathered across the business.

5. File your BOI reports

Filing a BOI report is available to the public on FinCEN’s website. There is no filing fee to submit the report, and FinCEN issues immediate confirmation to the filer. If that sounds way too easy, there are some pitfalls to watch out for:

- First, it’s a good idea to have all the information you need to submit the report when you start to file. The FinCEN portal does time out after a certain period of time, especially if you have to chase down information partially through the report.

- The report is about 60 questions long. Consider the amount of time you’ll spend submitting each report. For organizations with multiple entities, this by itself can be a large administrative burden.

- Consider how much effort it takes to report changes and updates. FinCEN requires the business to submit an entirely new report (and submit all of approx. 60 data points) for each entity every time there’s a change.

Finally, while FinCEN has not (yet) enforced the requirement, it’s a best practice to save any reports in your permanent records once they’ve been submitted.

6. Getting professional assistance

Millions of businesses have already submitted their BOI reports to FinCEN. Even still, millions of companies have yet to report before the end of the year—and in fact, aren’t even aware of their obligations. Our commitment at Simon Lever is to educate and provide you with resources to meet the requirements.

If you’re reading this article, you’re now “in the know.” Share this information with your leadership team and, if you’re committed to handling reporting on your own, you can contact FinCEN using the links above.

We also realize many of you have additional questions and may require professional help navigating this requirement. That is why we’ve partnered with Harbor Compliance, a Lancaster, PA-based provider of technology and professional services. Since 2012, they’ve helped over 40,000 organizations with all types of registration and compliance needs. Harbor Compliance offers a secure BOI reporting platform and filing service and would be happy to take this new, complex, and potentially scary requirement off your plate.

For more information about how Harbor Compliance can help, visit this page and fill out the form. Scheduling an initial consultation with their team is free. If you have any questions or other feedback on how Simon Lever can continue to support you and your business, don’t hesitate to contact your trusted Simon Lever advisor.

Update as of March 27, 2024

Beware of Fake Government Business Compliance Notices

SCAM ALERT: Please be advised of a BOI filing scam. Business owners have been receiving a “Form 4022” (which does not exist in the U.S. tax system) from the nonexistent “Business Regulations Department.” The form demands a $117 filing fee, as well as personal information about you and your business. We want to remind you that all BOI filing goes through FinCEN’s electronic filing portal and is free. Please disregard any Form 4022 that is received in the mail. Additionally, business owners should be vigilant and recognize the potential for receiving such scams and similar fraudulent activities. It is imperative not to respond to these notices. If you have questions about any forms that you are receiving, please reach out to your Simon Lever trusted advisor.

Update as of March 7, 2024

Court Ruling Limits BOI Reporting

In light of a significant ruling on Friday, March 1, by a federal district court in Alabama, which found that the Corporate Transparency Act—mandating Beneficial Ownership Information (BOI) reporting—was a constitutional overreach by Congress, rendering the Financial Crimes Enforcement Network (FinCEN) unable to mandate BOI reporting from members of the National Small Business Association as of now.

Following this, FinCEN clarified on Monday, March 4, that only members of the National Small Business Association (as of March 1, 2024) are exempt from filing BOI reports currently, with all other obligated entities expected to comply by year’s end. Given the anticipation of further legal challenges to the legislation, as well as an expected appeal of the court decision by FinCEN/Treasury, we will continue to monitor the situation closely and provide updates as they become available.

Originally posted on December 21, 2023

What is BOI Reporting?

Following provided by AICPA

Starting January 1, 2024, a significant number of businesses will be required to comply with the Corporate Transparency Act (“CTA). The CTA was enacted into law as part of the National Defense Act for Fiscal Year 2021. The CTA requires the disclosure of the beneficial ownership information (otherwise known as “BOI”) of certain entities from people who own or control a company.

It is anticipated that 32.6 million businesses will be required to comply with this reporting requirement. The intent of the BOI reporting requirement is to help US law enforcement combat money laundering, the financing of terrorism and other illicit activity.

The CTA is not a part of the tax code. Instead, it is a part of the Bank Secrecy Act, a set of federal laws that require record-keeping and report filing on certain types of financial transactions. Under the CTA, BOI reports will not be filed with the IRS, but with the Financial Crimes Enforcement Network (FinCEN), another agency of the Department of Treasury.

Below is some preliminary information for you to consider as you approach the implementation period for this new reporting requirement. This information is meant to be general-only and should not be applied to your specific facts and circumstances without consultation with competent legal counsel and/or other retained professional adviser.

What entities are required to comply with the CTA’s BOI reporting requirement?

Entities organized both in the U.S. and outside the U.S. may be subject to the CTA’s reporting requirements. Domestic companies required to report include corporations, limited liability companies (LLCs) or any similar entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

Domestic entities that are not created by the filing of a document with a secretary of state or similar office are not required to report under the CTA.

Foreign companies required to report under the CTA include corporations, LLCs or any similar entity that is formed under the law of a foreign country and registered to do business in any state or tribal jurisdiction by filing a document with a secretary of state or any similar office.

Are there any exemptions from the filing requirements?

There are 23 categories of exemptions. Included in the exemptions list are publicly traded companies, banks and credit unions, securities brokers/dealers, public accounting firms, tax-exempt entities and certain inactive entities, among others. Please note these are not blanket exemptions and many of these entities are already heavily regulated by the government and thus already disclose their BOI to a government authority.

In addition, certain “large operating entities” are exempt from filing. To qualify for this exemption, the company must:

- Employ more than 20 people in the U.S.;

- Have reported gross revenue (or sales) of over $5M on the prior year’s tax return; and

- Be physically present in the U.S.

Who is a beneficial owner?

Any individual who, directly or indirectly, either:

- Exercises “substantial control” over a reporting company, or

- Owns or controls at least 25 percent of the ownership interests of a reporting company

An individual has substantial control of a reporting company if they direct, determine or exercise substantial influence over important decisions of the reporting company. This includes any senior officers of the reporting company, regardless of formal title or if they have no ownership interest in the reporting company.

The detailed CTA regulations define the terms “substantial control” and “ownership interest” further.

When must companies file?

There are different filing timeframes depending on when an entity is registered/formed or if there is a change to the beneficial owner’s information.

- New entities (created/registered in 2024) — must file within 90 days

- New entities (created/registered after 12/31/2024) — must file within 30 days

- Existing entities (created/registered before 1/1/24) — must file by 1/1/25

- Reporting companies that have changes to previously reported information or discover inaccuracies in previously filed reports — must file within 30 days

What sort of information is required to be reported?

Companies must report the following information: full name of the reporting company, any trade name or doing business as (DBA) name, business address, state or Tribal jurisdiction of formation, and an IRS taxpayer identification number (TIN).

Additionally, information on the beneficial owners of the entity and for newly created entities, the company applicants of the entity is required. This information includes — name, birthdate, address, and unique identifying number and issuing jurisdiction from an acceptable identification document (e.g., a driver’s license or passport) and an image of such document.

Risk of non-compliance

Penalties for willfully not complying with the BOI reporting requirement can result in criminal and civil penalties of $500 per day and up to $10,000 with up to two years of jail time.

For more information about the CTA, visit https://www.fincen.gov/boi.

Please consult with your legal advisors with any questions regarding these reporting requirements.